Running Your Business: Day-to-Day, Ongoing & Annual Requirements

In this guide, we'll cover what you need to do to run your business effectively, from the day-to-day operations through to ongoing and annual requirements. We'll also try to cover what you can expect to have to pay, so you don't encounter any surprises.

Sales

Sales invoices must be issued to your customers for all your sales. Invoices should always be sequentially numbered, without gaps, to maintain accurate records.

Sales Invoices should always include the following essential items:

- Your company name, address, and contact information

- The company name and address of the customer you’re invoicing

- A clear description of what you’re charging for (goods or services)

- The date the goods or service were provided (supply date)

- The date of the invoice

- The amount(s) being charged

- VAT amount if applicable (and your VAT registration number if you are VAT registered)

- The total amount owed

Purchases

You should retain invoices or receipts for all items you purchase for your business, including those purchased using the business bank account and petty cash.

It's important that receipts and invoices from your purchases do not include any personal purchases where possible. Always try to obtain separate receipts for business purchases when they are made alongside personal purchases, to keep your records clear and avoid complications.

Dividends

If you are a limited company, you may pay dividends to your shareholders. You must ensure the business has sufficient **distributable profits** to pay these dividends; otherwise, they are considered to be illegal.

Any dividend payments must be formally agreed by the board of directors, with accurate minutes of the board meeting recorded. A **dividend voucher** must then be created for each payment to each shareholder, detailing the amount and the company's information.

Record Retention Periods

You must keep business records for a specific period. Generally, you need to retain records for 6 years from the end of the last company financial year they relate to. You may need to keep them longer if:

- They show a transaction that covers more than one of the company’s accounting periods.

- The company has bought something that it expects to last more than 6 years, like equipment or machinery.

- You sent your Company Tax Return late.

- HMRC has started a compliance check into your Company Tax Return.

Record Keeping - Payroll

What to Keep Records Of

For payroll, you must collect and keep detailed records of:

- What you pay your employees and the deductions you make (e.g., PAYE, National Insurance).

- Reports you make to HM Revenue and Customs (HMRC).

- Payments you make to HMRC.

- Employee leave and sickness absences.

- Tax code notices.

- Taxable expenses or benefits provided.

- Payroll Giving Scheme documents, including the agency contract and employee authorisation forms.

A lot of these records are managed and kept as part of your payroll files that we process for you – as part of our payroll services.

Payroll Record Retention Period

Your payroll records must show you’ve reported accurately, and you need to keep them for 3 years from the end of the tax year they relate to. HMRC may check your records to make sure you’re paying the right amount of tax.

Record Keeping - Mileage Claims

Claiming Mileage Allowance

When you use your personal vehicle for business purposes, you may be able to claim back the Mileage Allowance from your company. This allowance enables your business to claim an allowable expense associated with business mileage in your private vehicle; it also allows you, as the individual, to recover some costs associated with using your vehicle.

The current (2024) advisory rate is 45p per mile for the first 10,000 miles, and covers your personal expense of fuel used, as well as wear and tear on your vehicle. Your business will pay the amount of mileage claimed to you, as the individual, and claim that expense in its accounts.

Records to Keep for Mileage

You will be required to keep a detailed record of your business mileage for your personal vehicle, including:

- Starting postcode

- Ending postcode

- Reason for the travel

- The number of miles travelled

Note: Travelling to and from your regular place of work is generally not considered business mileage.

You should submit your mileage records to us for each complete calendar month as soon as possible after the end of the month. That way, we can get your records updated promptly and advise you of any potential issues. You don't need to send us the full details, just a summary of what you are claiming, provided you keep the detailed records yourself.

Record Keeping and Data Protection

By holding and processing personal information about the people you do business with, and that of your employees, you may need to register with the ICO (Information Commissioner's Office) and pay a Data Protection Fee.

The ICO website contains comprehensive information about this topic, as well as a tool to determine if you should register with them. Please see our guide on the ICO Fee for more information.

Running Payroll

What to do Each Pay Period

Every pay run, you will need to send us details of each employee's pay. We will then process your payroll, make the necessary deductions, and generate summaries for you and payslips for your employees.

You will then pay your employees based on their net pay.

Payroll Taxes

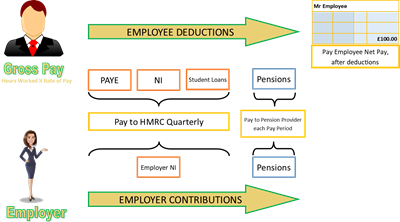

Where applicable, PAYE, National Insurance, Pensions, and Student Loans are deducted from your employees' gross pay. You will be paying your employees the net amount after these deductions, meaning you will be holding onto the taxes that they are paying.

Every quarter (or 3 months), we will advise you on the total of these deductions, and you'll need to pay this amount to HMRC on your employees' behalf.

For pensions contributions, you will pay the amount deducted to your pension provider.

In addition to employee deductions, you may also pay Employer's National Insurance Contributions alongside the payments you're making on behalf of your employees.

- For Employer's NI, this is paid to HMRC with your employees' taxes.

- For Pensions, you'll add in your Employer Contributions and pay that alongside your employees' contributions to your pension provider.

Holiday Pay

In addition to the regular wages you pay your employees, they will also accrue holiday pay. There are a few different methods of calculating Holiday Pay, and you should use the appropriate one for your business.

You will have to pay out from this accrued balance when an employee takes time off, or when an employee leaves. It is worth considering that besides the wages you pay to an employee, you also have this **liability** and need to be able to cover this cost.

Putting Aside and Paying Taxes

There are different forms of taxes, payable throughout the year and annually, that you need to plan for.

VAT

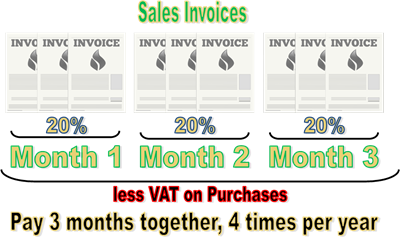

If you're VAT Registered, you will typically pay your VAT every 3 months, resulting in 4 payments per year. The months covered in each period will be determined by when you initially registered.

Every vatable sale you make will include 20% (or the applicable rate) which you collect from your customer and will need to pay to HMRC. You should aim to put aside this 20% from every sale to cover your VAT bill. Any input VAT from purchases will reduce the amount of VAT you owe, but by consistently setting aside 20%, you ensure you always have enough saved.

Remember, the VAT collected is not technically your business's money; you collected it from your customer on behalf of HMRC and will need to pay it on to them.

After each VAT quarter, once we have all of your documents, we will advise and seek your approval to submit your VAT Return. Once submitted, you will need to send this money to HMRC.

You can pay via your Government Gateway Login, where you can also set up a Direct Debit. We highly recommend setting up a Direct Debit so that you never miss a payment deadline.

Payroll Taxes (PAYE & NI)

Each pay period, you will deduct taxes owed by your employees from their pay. You need to hold onto these taxes and pay them to HMRC each quarter.

Along with the taxes you hold for your employees, you may also have to pay **Employer's National Insurance** at the same time.

For Pensions, you deduct employee contributions from their pay the same as taxes, but you pay this to your pension provider each pay period, along with your Employer Contributions.

For every pay period we process as part of our payroll services, we send you an Employer's Summary, which details the total amount of deductions and contributions you need to set aside.

Each quarter, we will send you a P30, which outlines exactly how much you need to pay to HMRC, the reference to use, and when it needs to reach HMRC by.

Annual Taxes

If you are a business operating as a limited company, you will have to pay **Corporation Tax** each year on your taxable profits. If you're an individual operating as a sole trader, you'll have to pay **Self Assessment** income tax and National Insurance each year on your taxable profits.

This means that at the end of each accounting period, you should expect to pay tax at the relevant rate on any profits you make. You should check what your expected tax rate may be and ensure you have enough set aside to cover this liability.

We always recommend putting aside at least 20% of your business income to cover your tax bill, especially if you are a small business.

For Self Assessment, you may need to make a Payment on Account. This essentially splits your next year's bill up, and you pay part of it in advance. If you have to pay a Payment on Account, you should factor this into the amount of money you put aside for tax.