SGL ACCOUNTANCY SERVICES

Small Business & Sole Trader Accountants - Supporting Clients Across the UK

Accountants for Small & Growing Businesses

Accounting Partner for Growing Businesses in South Yorkshire & Across the UK

Welcome to SGL Accountancy Services - AAT Licensed Accountants in Doncaster, South Yorkshire, providing seamless digital services to businesses across the UK.

We specialise in supporting Growing Businesses and Sole Traders with Self Assessment, Company Accounts, VAT Returns, Payroll, and Making Tax Digital (MTD) for Income Tax.

Our Accountancy Services

Accounting Solutions for Sole Traders & Growing Businesses

Whether you are a limited company, a VAT-registered business, or a sole trader looking for annual tax return support, we have a service to fit.

If you are a sole trader transitioning to the new digital tax rules, our MTD Packages provide everything you need—from ongoing bookkeeping to your final Self Assessment submission—ensuring you stay fully compliant with HMRC while losing the paperwork stress.

Accounts Packages

Our comprehensive Accounts Packages are designed to meet all of your business needs throughout the year.

- Bookkeeping

- Quarterly VAT Returns

- Year End Accounts:

- Sole Trader: Self Assessment

- Limited Company: CT600

Includes

MTD Sole Trader Packages

Our new MTD Sole Trader Packages are for current users of annual Self Assessment, who must now start using Making Tax Digital ITSA.

- Bookkeeping

- Making Tax Digital (MTD) Compliant Record Keeping

- Making Tax Digital (MTD) Compliant HMRC Quarterly Updates

- Year End Self Assessment Accounts

- Optional VAT Returns

Includes

Annual Accounts

Our Annual Accounts services takes care of your year-end compliance - for Sole Traders, Limited Companies and small businesses.

- Profit & Loss statements & Balance Sheet

- Self Assessment Tax Return for Sole Traders

- Corporation Tax Return CT600 for Companies

- Tax Calculation

- Submission to HMRC & Companies House

Includes

Payroll

Our payroll service handles your weekly or monthly payroll, Auto Enrolment Pensions, and CIS for Subcontractors — ensuring full HMRC and RTI compliance for small businesses.

- Calculation of PAYE (Tax) and National Insurance deductions

- RTI Submissions & Payslips

- Standard Documents, such as P45, P60s

- Auto-Enrolment Pensions administration

- Construction Industry Scheme (CIS) support

Includes

Why Choose SGL Accountancy Services?

As an AAT Licensed practice, we specialise in helping businesses and sole traders navigate the complexities of tax and finance. Our seamless digital services allow us to support clients across the UK, ensuring you stay compliant and tax-efficient no matter where you are based.

- All-Inclusive Support: One fixed monthly fee covering your year-round accountancy and tax needs.

- Digital-First: Seamless online bookkeeping and Making Tax Digital (MTD) support.

- Compliance: Fully HMRC-compliant payroll, VAT returns, and company accounts.

- Expertise: AAT Qualified and Licensed Accountants.

- Local accountants in Doncaster, Mexborough, Rotherham - also serving the wider South Yorkshire and UK

We work with retailers, trades, creatives and service providers across South Yorkshire and nationally

Shaun Long is licensed and regulated by AAT under licence number 1007979. AAT is recognised by HM Treasury to supervise compliance with the Money Laundering Regulations and SGL Services Ltd is supervised by AAT in this respect.

AAT Licensed Accountant

Regulated Excellence and Professional Standards You Can Rely On

Our Doncaster-based accountancy practice is licensed by the AAT, ensuring we adhere to the highest professional standards as accountants and rigorously comply with Money Laundering Regulations.

This robust supervision gives our clients the confidence that we are competent and professional.

Simplifying Digital Tax

Future-Proofing Your Business for Making Tax Digital (MTD)

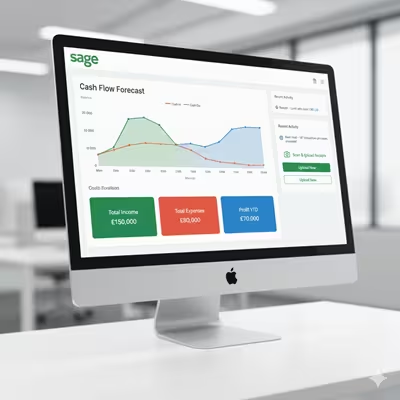

With our packages you can manage your business' finances digitally using cloud software - getting an overview of your business performance at any time.

Say goodbye to paper bank statements and complicated exports

Connect your bank to the cloud software, so we automatically receive your bank transactions and process them without your intervention.

No more shoeboxes of receipts

You can send in your paper receipts by taking a photo of them. They'll come straight to us for processing.

We won't leave you behind

As the tax landscape shifts to a digital-first approach with initiatives like Making Tax Digital (MTD), we ensure all clients are prepared.

We help you navigate these changes seamlessly, handling the technology so you don't have to. You don't need to be an expert in digital — we'll be there to guide you every step of the way.

Learn more about how we support Making Tax Digital for Income Tax on our MTD ITSA page.

All Our Services

SGL Accountancy Services offers a full range of small business accounting services — from bookkeeping and VAT to payroll and CIS compliance — all available locally in Doncaster and online nationwide.

Expert Bookkeeping Services for UK Businesses

Efficient and accurate bookkeeping services are the backbone of any successful business. We handle your day-to-day financial transactions ensuring your records are meticulously maintained and up-to-date. This frees up your valuable time to focus on growing your business, giving you peace of mind.

- Recording all sales and purchase invoices

- Categorising income and expenses accurately

- Processing bank transactions and reconciling bank accounts

What our Bookkeeping Service Includes:

Corporation Tax Compliance & Optimisation

Navigating Corporation Tax can be complex for UK limited companies Our comprehensive service covers the precise calculation and submission of your Corporation Tax return (CT600) to HMRC ensuring full compliance and identifying opportunities for tax efficiency.

- Preparation of statutory annual accounts (Profit & Loss, Balance Sheet)

- Accurate Corporation Tax calculation

- Filing of accounts with Companies House

- Submission of the CT600 tax return to HMRC

- Advice on available tax reliefs and allowances to minimise your tax liability

- Ensuring deadlines are met to avoid penalties

Our Corporation Tax Services include:

Streamlined Self Assessment Tax Returns

Whether you're a sole trader, landlord, or receive untaxed income our Self Assessment tax return service simplifies your annual tax obligations. We accurately calculate your income tax liability and ensure your return is correctly submitted to HMRC by the deadline, helping you avoid penalties.

- Preparation of personal income and expense summaries

- Calculation of income tax and National Insurance contributions

- Reporting various income sources (e.g., self-employment, property income, dividends)

- Claiming all eligible expenses and tax reliefs

- Digital submission of your SA100 tax return to HMRC

- Guidance on payments on account

Our Self Assessment Service includes:

Making Tax Digital for Income Tax Self Assessment (MTD ITSA) Compliance

Stay ahead with Making Tax Digital for Income Tax Self Assessment (MTD ITSA) compliance. From April 2026, many sole traders and landlords will need to keep digital records and submit quarterly updates. We provide the expertise and support to ensure your business seamlessly transitions to and complies with MTD ITSA regulations.

- Implementing MTD-compatible accounting software

- Setting up digital record-keeping systems for income and expenses

- Preparing and submitting quarterly updates to HMRC

- Filing the End of Period Statement (EOPS) and Final Declaration

- Guidance on MTD ITSA requirements and deadlines

- Ensuring you meet all digital reporting obligations

Our MTD ITSA Compliance Service includes:

Accurate VAT Return Preparation & Submission

For VAT-registered businesses, timely and accurate VAT returns are essential. We manage the calculation of your VAT liabilities and ensure your VAT returns are submitted digitally to HMRC in full compliance with Making Tax Digital (MTD for VAT) rules. Avoid errors and penalties with our expert assistance.

- Reviewing sales and purchase records for VAT purposes

- Accurate calculation of input and output VAT

- Completing all boxes of your VAT Return (VAT100)

- Digital submission to HMRC using MTD-compliant software

Our VAT Return Service includes:

Efficient UK Payroll Management Services

Managing payroll can be time-consuming and complex, especially with constantly evolving UK employment laws and HMRC regulations. We offer comprehensive weekly or monthly payroll services to ensure your employees are paid accurately and on time, and that your business remains compliant.

- Processing weekly or monthly payroll runs

- Calculating PAYE, National Insurance (NI), and other deductions

- Issuing professional payslips

- Preparing and submitting RTI (Real Time Information) reports to HMRC (FPS & EPS)

- Handling auto-enrolment pensions administration, including NEST

- Processing new starters (P45, P46) and leavers (P45)

- Producing annual summaries like P60s

- Managing statutory payments (SMP, SPP, SSP etc.)

Our Payroll Services include:

Construction Industry Scheme (CIS) Compliance for Contractors & Subcontractors

The Construction Industry Scheme (CIS) has specific rules for contractors and subcontractors in the UK construction industry. We provide specialist support to ensure you meet your CIS obligations, from verifying subcontractors to submitting monthly CIS returns to HMRC, saving you time and preventing penalties.

- Contractor registration and verification of subcontractors with HMRC

- Calculating and deducting CIS tax from subcontractor payments

- Preparing and issuing payment and deduction statements to subcontractors

- Monthly submission of CIS300 returns to HMRC

- Ensuring full compliance with CIS regulations

Our CIS Services include:

Frequently Asked Questions

Do you offer accountancy services for sole traders in Doncaster?

Yes. We provide full bookkeeping, self assessment and Making Tax Digital support for sole traders across Doncaster,South Yorkshire, and the wider UK.

Why choose SGL Accountancy Services?

We are AAT Licensed accountants specialising in small business and sole trader accounts. We provide professional, affordable, and personalised services in Doncaster and across the UK.

What is Making Tax Digital (MTD)?

Making Tax Digital is an HMRC initiative to move tax reporting online. We help businesses transition to MTD-compliant software for VAT and Income Tax.

How much do your accountancy services cost?

We offer fixed-fee accountancy packages and competitive rates for annual accounts and payroll. Contact us for a tailored quote.

Helpful Business Guides

Practical advice for sole traders and small businesses